Key takeaways:

- What is a Google Sheets budget template? This is a prebuilt spreadsheet to organize income, expenses, and savings for effective financial tracking.

- How does a budget template benefit users? It simplifies budgeting tasks, tracks expenses, reduces errors, sets financial goals, and saves time.

- What steps are involved in using a Google Sheets budget template? Create a Google account, copy the template, add income, fill expenses, and set budget limits.

- How do I choose the right budget template? Look for clarity in income and expense sections, ease of reading, and functional formulas.

- When should I use project management tools over Google Sheets? For larger teams needing robust visibility, automation, and real-time collaboration, project management tools like Wrike are ideal.

As a project manager, I’ve learned that if you can’t manage your budget, you can’t manage your work. I’ve led everything from small internal projects to large cross-functional rollouts, and keeping track of expenses, timelines, and resources always comes down to using the right budgeting tools.

One thing I always rely on is a monthly budget template. And when you’re getting started or need something fast, a free Google Sheets budget template can be a powerful way to organize costs and keep your team aligned.

In this guide, I’ll walk through how I use templates to manage spending, map out income, and keep finances visible throughout the lifecycle of a project.

What is a Google Sheets budget template?

A Google Sheets budget template is a prebuilt spreadsheet you can use to organize your income, expenses, and savings. It helps you track your financial transactions.

Benefits of using a budget template

If you want to take control of your money without overcomplicating the process, a Google Sheets budget template is one of the easiest tools you can use. A Google budget spreadsheet template helps you:

- Track your spending and understand where your money is going

- Stay within your budget by keeping your expenses visible and easy to manage

- Simplify your financial goals by setting targets and visualizing progress regularly

- Reduce errors with built-in formulas that handle the calculations for you

- Save time on budgeting tasks so you can focus on decisions, not data entry

- Adjust categories and fields to match how you manage your finances

- Build consistency by using the same format month after month

How to use a Google Sheets budget template

If you’re new to Google Sheets, getting started is easy. Google Sheets is an online program for making and editing spreadsheets. You don’t need to be an expert to use Google budget spreadsheets. Here’s a simple step-by-step guide to get started.

Step 1: Create a Google account

Setting up a Google Sheets budget template takes just a few minutes. If you don’t already have one, set up a free Google account. Then, go to Google Drive and open Google Sheets. This is where you’ll manage your budget going forward.

Step 2: Make a copy of the template

Open the template and save a copy to your Google Drive. Rename the file with the current month so you can stay organized and refer back to it later.

Step 3: Add your income

Enter all your sources of income or your paycheck for the month. This could be your full-time job, freelance work, or any other reliable payments. Use actual numbers so the rest of your plan is realistic.

Step 4: Fill in your expenses

List both fixed and variable expenses under clear categories. Fixed items might include rent, insurance, or subscriptions. Variable items could be groceries, fuel, or personal spending.

Step 5: Set budget limits

Add your planned amounts in the budget column and update the actuals as you go. The built-in formulas will calculate totals and show you how you’re doing. At the end of the month, take a few minutes to review and prepare for the next cycle.

How to choose the right Google Sheets budget template

Not all templates are built the same. The right option should give you enough structure without overcomplicating your financial goals. Look for a budget spreadsheet template that includes clear sections for income, expenses, and totals. Make sure the layout is easy to read and the formulas work without needing edits.

If you’re paid more than once a month, pick a budget template that lets you split your income by week or fortnight. If you’re budgeting for a household or team, go for one that supports shared access and has space for notes or extra categories.

Google Sheets budget template vs. project management tools

When it comes to managing a monthly budget, the best tool depends on how complex your needs are. For larger teams, project management tools could offer more structure and visibility. However, if you need a quick-start solution that anyone can open and edit, I suggest you use a Google budget spreadsheet template.

And here’s one we prepared earlier! Download our monthly budget template for free.

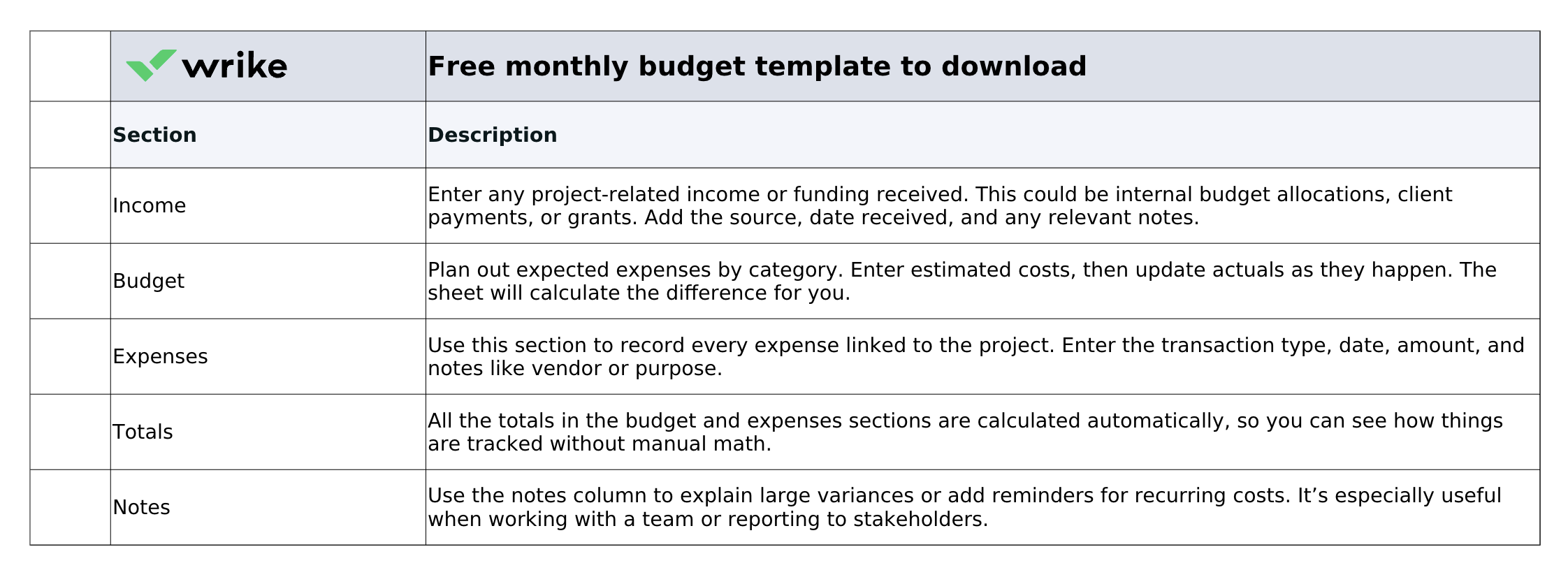

Free monthly budget template to download

Here’s a simple Excel file version of our monthly budget template. You can open it in Excel, or upload it to your Google Drive to use it in Google Sheets.

Tab 1: Info

This free monthly budget template is for project managers, freelancers, or small teams who need a simple way to track income and expenses across a single project or time period.

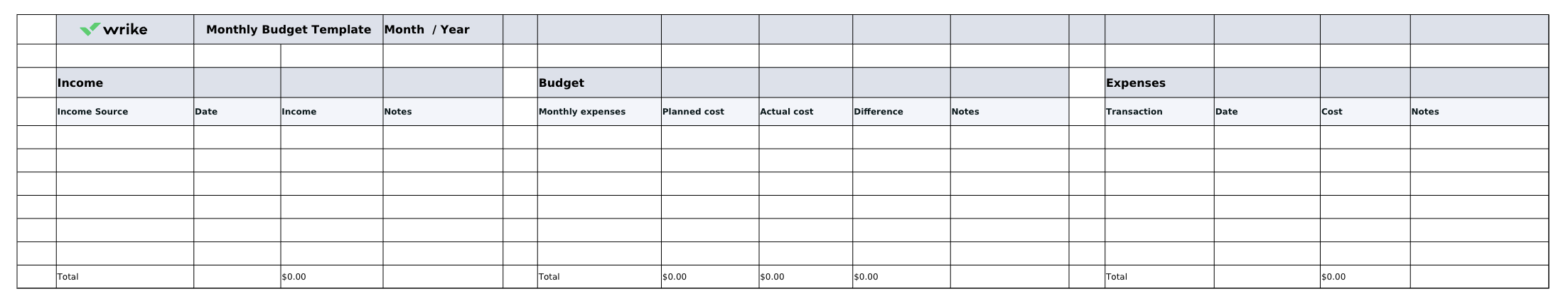

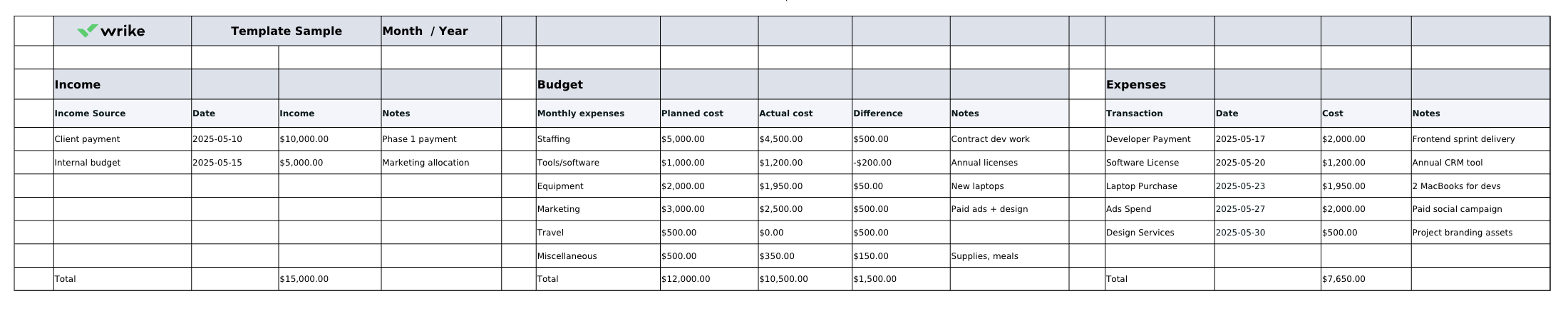

Tab 2: Blank template

Tab 3: Sample

Monthly budget template for project management tools

If you’re managing a team, handling recurring cost reports, or trying to bring all your financial activity into one place, project management tools make it easy to stay in control. For example, Wrike’s monthly budget tracker template includes everything you need to plan, collect, review, and report on your expenses in one shared workspace.

Now that we’ve explained the two options in detail, which budget template fits you best? Here’s an easy comparison to help you decide what works for your situation:

| Feature | Google Sheets budget template | Monthly budget template for project management tools |

| Best for | Individuals, freelancers, small teams | Finance teams, managers, multiproject teams |

| Setup | Minimal, just copy and edit | Prebuilt, ready to use |

| Accessibility | Google Sheet (cloud-based) | In-app (Wrike workspace) |

| Collaboration | Basic sharing | Real-time team access with roles |

| Visibility | Spreadsheet view only | Calendar, report views, Gantt chart, dashboards |

| Customization | Full control of structure and layout | Custom folders, forms, and workflows |

| Automation | Basic formulas | Built-in automation and workflow tools |

| Security | Limited to Google permissions | Enterprise-grade security in Wrike |

Budgeting tips using a Google Sheets budget template

Not sure how to get the most out of your Google Sheets budget template? Here are a few simple tips you should keep in mind:

- Create a separate tab for each project to keep your budgets organized and easy to manage.

- Set aside a row to track long-term savings so they don’t get lost among short-term expenses.

- Use color coding to highlight categories where spending often goes over your target.

- Add a column to track recurring expenses like subscriptions or memberships, so you only need to enter them once.

- Include debt in your plan so repayments are built into your budget.

- Make it a habit to check your numbers consistently every week.

- If you prefer writing things down, keep a small notebook or tablet nearby to jot down spending before you add it to your file.

Google Sheets budget template on Reddit

Before finalizing this guide, I checked Reddit to read and learn how people use Google Sheets to track their savings. It’s full of different stories from people managing their money in various aspects of life and figuring out what tool to use to plan their finances. What stood out was how many people rely on simple spreadsheets like Google Sheets to keep their finances in check.

One user shared:

“We use Google Sheets for our budget and buy everything on a shared visa for spending tracking. Then we have 5 accounts with our bank for easy budgeting as well (his fun, her fun, bills, emergency, and short-term savings). So easy!”

Another user in the community mentioned:

“The chart is a great idea!!! That is totally how I started out, too! I readjust my budget amounts mid-month too, if I’m in the red zone (like taking $200 from personal or other to transportation if I needed to spend money to get my car fixed unexpectedly). I think as I keep using it, it’ll be easier to hone into a good amount for each category.”

Why use a project management tool for budget tracking?

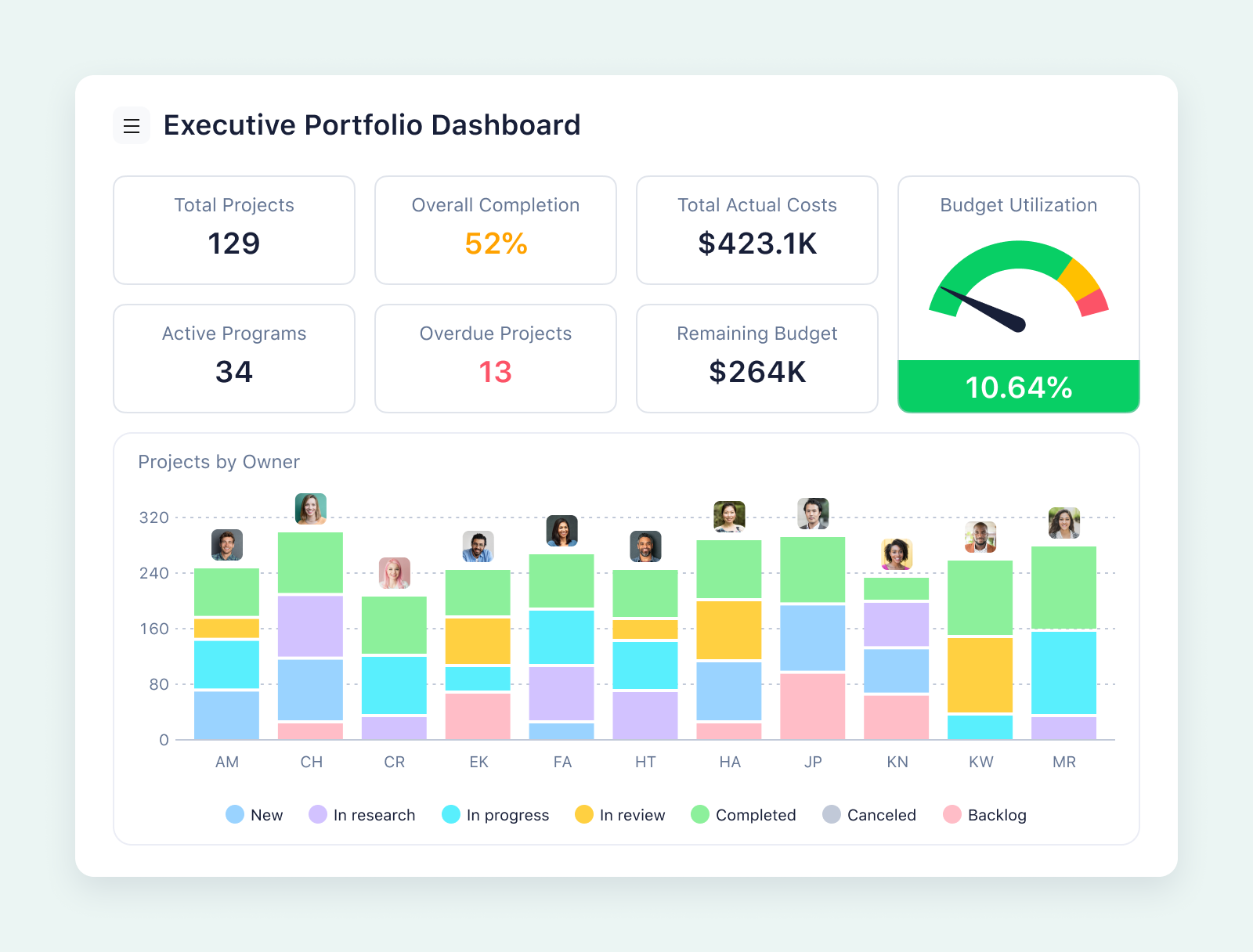

If you need a more robust platform than Google Sheets, Wrike is the answer. Wrike lets you break down your budgeting project into manageable tasks, each with its own subtasks, deadlines, and assignees.

You also get customizable dashboards and reporting tools that allow for detailed financial analysis.

Wrike kept everything organized and transparent, so it was always very easy to see the status ... because of the tagging feature, we were able to keep things moving very quickly.

Alex Bacon, Marketing Project Manager