Key takeaways:

- Why is banking project management challenging? Banking projects are highly technical, tightly regulated, and involve multiple specialized teams, making coordination and oversight essential.

- How does banking project management software help? It centralizes tasks, workflows, communication, and documentation, helping teams stay compliant, organized, and audit-ready.

- What’s the benefit for cross-functional collaboration? Shared dashboards, standardized workflows, and real-time visibility help business, technical, and compliance teams stay aligned without slowing work down.

Banking project managers are being asked to juggle more projects, teams, and stakeholders than ever before. Competition has driven up customer expectations. And on top of the increasing complexity and pressure, the strict regulations in the industry mean every project needs to stay secure, compliant, and fully auditable as you navigate those challenges.

Whether you work in a consumer bank, neo bank, credit-focused organization, or in investment and wealth management, project managers need tools to help them:

- Stay on top of a heavy workload, with a high number of new tasks and tight deadlines

- Connect teams to deliver shared projects, especially when that means coordinating each team’s preferred workflow

- Work transparently, breaking down information silos and keeping their work auditable

- Evaluate past projects to help deliver their new offerings effectively

The bottom line is that it’s extremely difficult to navigate these challenges without dedicated software. So, in this post, I’ll showcase banking project management software that delivers all of these benefits, with customer stories from real Wrike users in the sector.

3 key challenges in banking projects

When you first look for tools to manage a project in a financial institution, you’ll come across basic task tracking or project dashboard apps. But while these tools can work for short-term projects and small teams, they’re usually not robust enough for the complexities of a full-scale banking project.

If you’re ready to improve your project management systems, there are three very good reasons to look for a powerful platform from the start.

1. Banking projects are deeply technical

Rapid digital transformation in the banking sector altered expectations from private and business customers. Banks aren’t just banks anymore, and teams face pressure to offer an ecosystem of on and offline services. This makes projects highly technical and complex, and requires teams to work to demanding deadlines in order to meet those customer expectations.

The key to managing these large-scale, technical projects is oversight. You need software to monitor your project performance, prove the ROI, and identify areas to streamline — both for the customer and your project team.

2. Banking projects are highly regulated

In this sector, errors in your project plan or data management can lead to fines, reputational damage, financial losses, and customer churn. Project managers have to think about ongoing risk management and maintain audit trails to show when decisions were made, who was involved, and what they discussed — something that’s difficult to do efficiently if your system is based on spreadsheets and emails.

Here, you need software that standardizes the way you work and the way that work is recorded. This framework balances the fast pace of your projects with the accuracy you need to keep your work compliant and stay audit-ready.

3. Banking projects are cross-functional

Partly because of the first two challenges on this list, banking and financial services projects often need input from a range of different departments. Cross-functional projects in this sector can look like:

- Legal teams working with portfolio managers to create roadmaps to manage regulatory changes

- UX teams working with client-facing service teams to improve the design of an online banking interface

- Marketing teams working with development teams (and, again, legal) to create and roll out campaigns for new services

This cross-functional work is particularly complex because each team has its own well-established, tightly controlled workflows to manage. This is a challenge for communication and coordination.

The only true solution here is a scalable piece of project management software — one powerful enough to be used as a shared source of truth throughout a long-term project and beyond. This way, teams can keep the granular workflows they’ve developed to ensure they’re working compliantly, and project managers can close the process gaps that slow shared projects down.

Wrike is a fully customizable work management platform for complex teams and long-term project cycles.

In the next section of this post, I’ll explore the ways that Wrike supports banking project managers and their teams in their work.

How project management software can help

There are several clear reasons to choose Wrike as your banking project management platform.

- Wrike grows with you, so you can use our tools for long-term, complex projects managed across multiple teams or departments. Unlike more basic project management tools, you don’t have to worry about hitting a ceiling in terms of task volume or the number of active projects in your portfolio.

- Wrike is secure, with enterprise-grade security features to protect your data, a detailed system of access roles and permissions, and features to help your workflows comply with regulatory requirements.

- Wrike is customizable, so every subteam in your project can tailor their folders, templates, dashboards, and workflows to their internal processes and approval requirements.

Most importantly, Wrike gives you all these features in a single piece of software, which speeds up your project work, closes the gaps in your processes, and provides you with a complete overview of the entire lifecycle of your project.

Let’s look at these features in more detail.

Handle complex tasks and projects with ease

Compared to more basic project management tools — and in stark contrast to spreadsheets and databases — Wrike is set up to manage and visualize complex project processes in real time. More importantly, you can customize and automate many aspects of your project overview, while still maintaining effortless access to the data on task history, ownership, and status.

For example, if your bank is developing a new service offering — like expanding into insurance or launching a loyalty program — Wrike breaks down a complex project into achievable, quantifiable tasks. What’s more, Wrike helps you build the systems you need to keep those tasks organized. As well as simply tracking your work, a Wrike workspace can:

- Provide Agile project management tools like a Kanban board and backlog box to support your team through each iteration of the development process

- Save and consolidate your learnings in project folders, so you can easily share and reflect on the results

- Centralize and record your written communications, so your team can discuss the results of their experiments in the early phases of the project within Wrike rather than shifting the discussion into an external tool

With these tools, complex project tasks exist within Wrike in far more detail than they would as items on a to-do list. You can see how they fit together, how they’re progressing, and the stages where issues like bottlenecks might develop. When all the team members working on the project share this overview, you can work more collaboratively and responsively together to navigate challenges as they arise.

In practical terms, I find these are the tools financial teams are most likely to reach for when managing a long-term project:

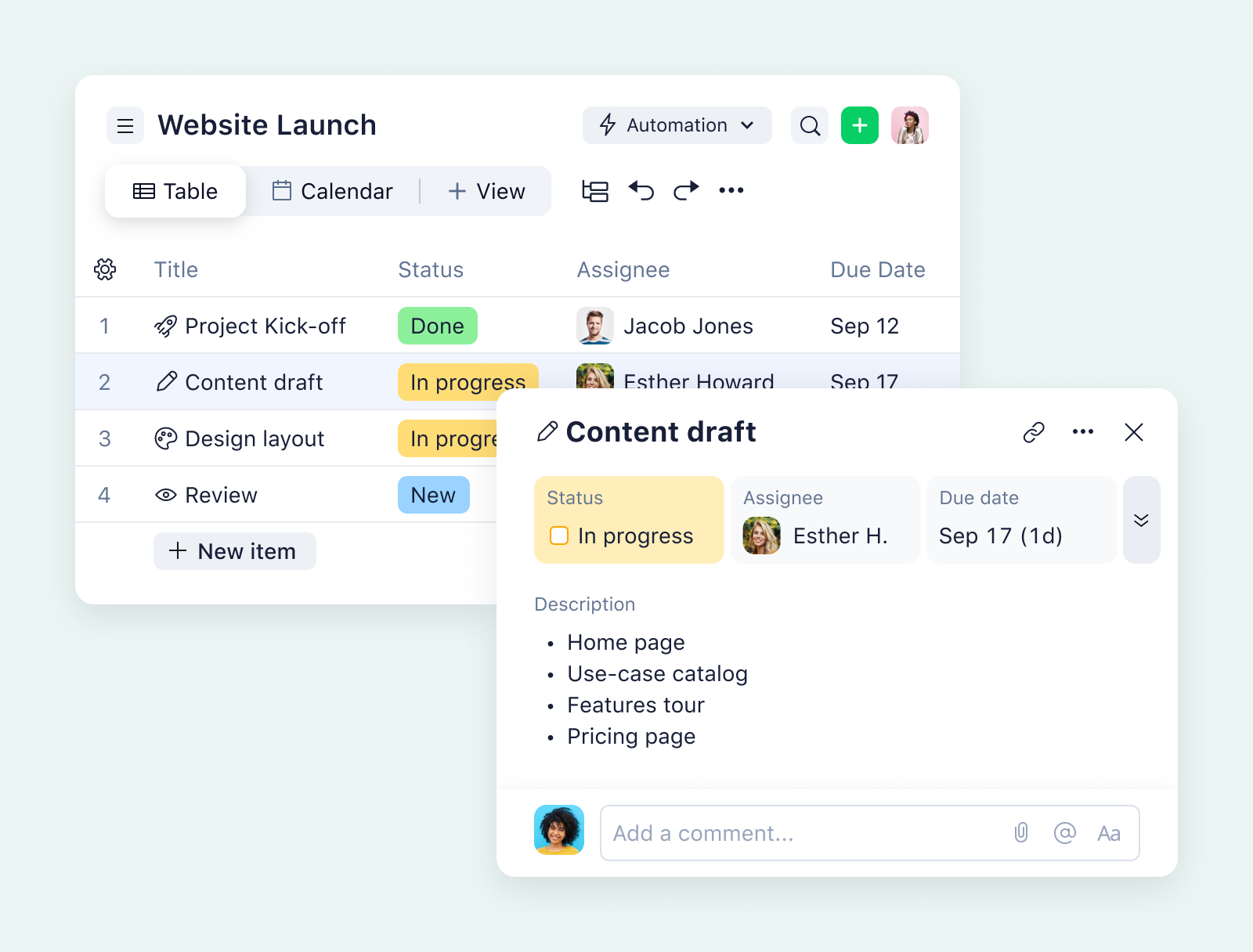

For task and workflow management, Wrike creates custom workflows for each project task or custom items to standardize the processes for your repeatable tasks.

A prime example here is a document workflow, which ensures all the documents you create for a project meet the same rigorous standards. These workflow stages clarify who is responsible for writing, collecting, and approving the documents involved in, for example, an M&A process.

Wrike also includes templates to set up your workspace for many aspects of project management and change management. Search our project management templates here.

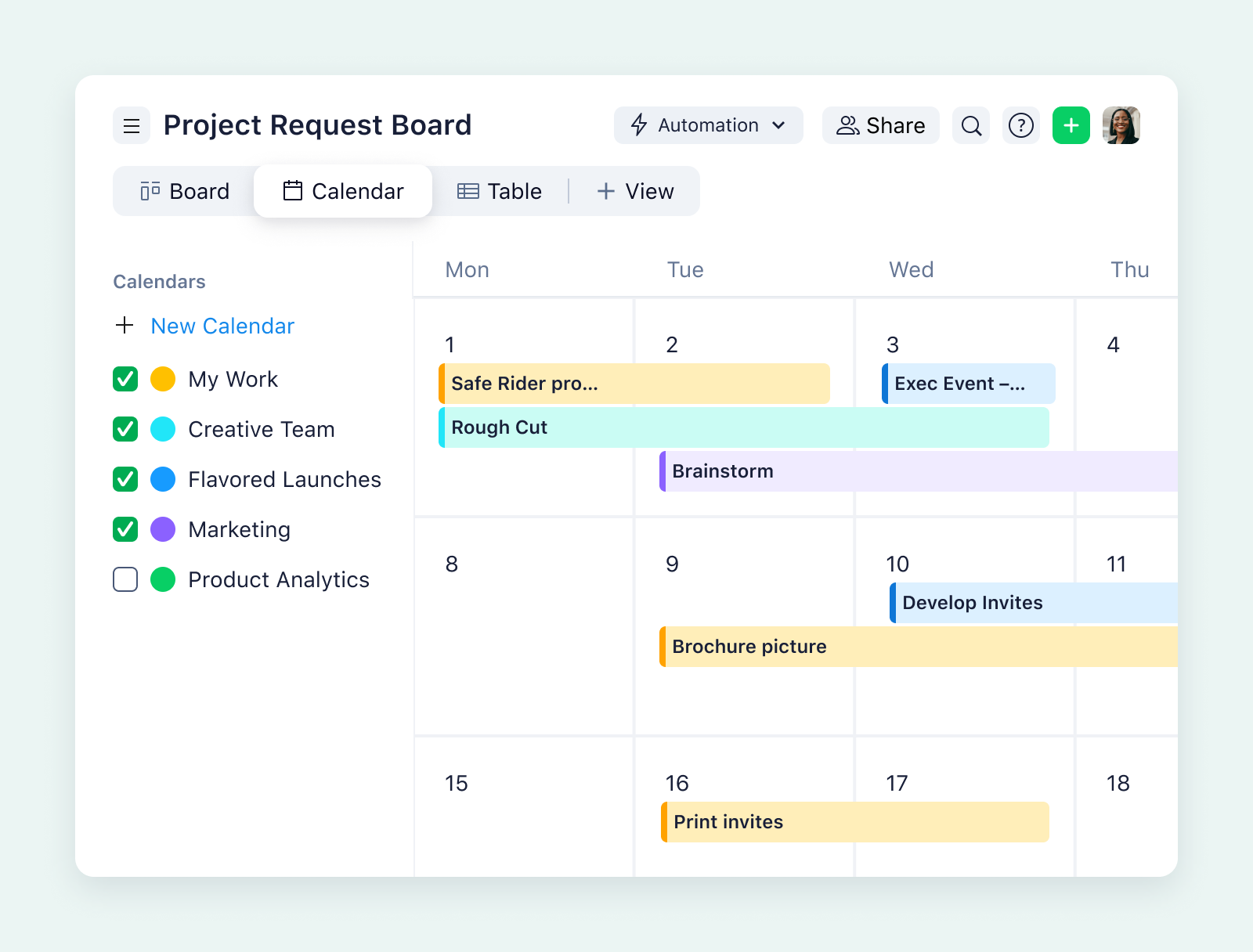

You can also organize your workspace with multiple overviews to switch between: for example, a Gantt chart overview of your project timeline and task dependencies, and a calendar view to show your team’s schedule and capacity. By combining these features and comparing the visualizations, you can view your work from all angles, make more effective decisions about resource management, and deliver your work on time.

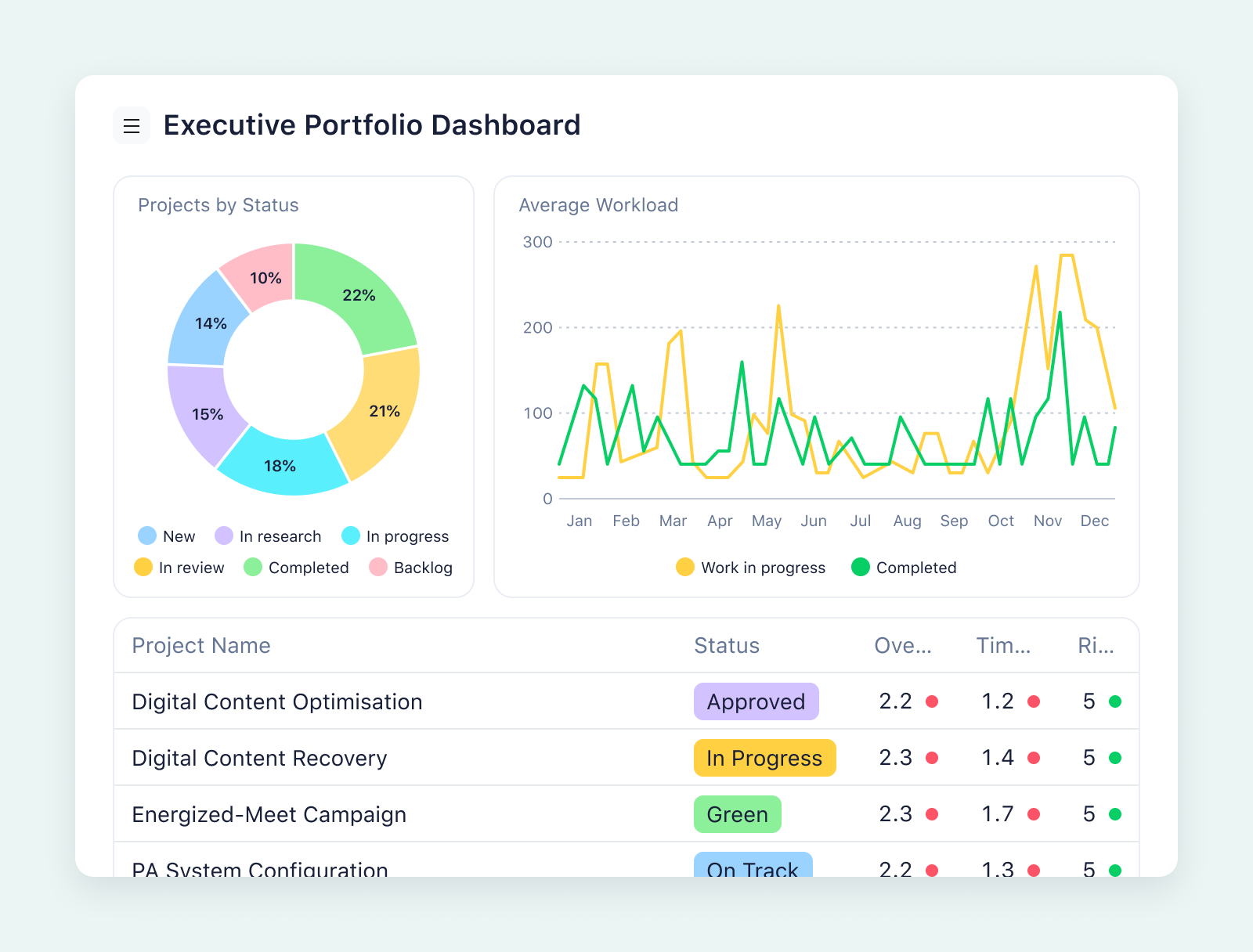

Wrike’s user-friendly portfolio dashboard features can show everything from the number of projects in your pipeline, to the latest updates, to a forecast of the projects most at risk. From there, it’s still easy to dive from overview, to task card, to the individual team when you need a detailed update. This helps you prioritize your projects strategically and plan the long-term direction of your work.

Keep your work secure and audit-ready

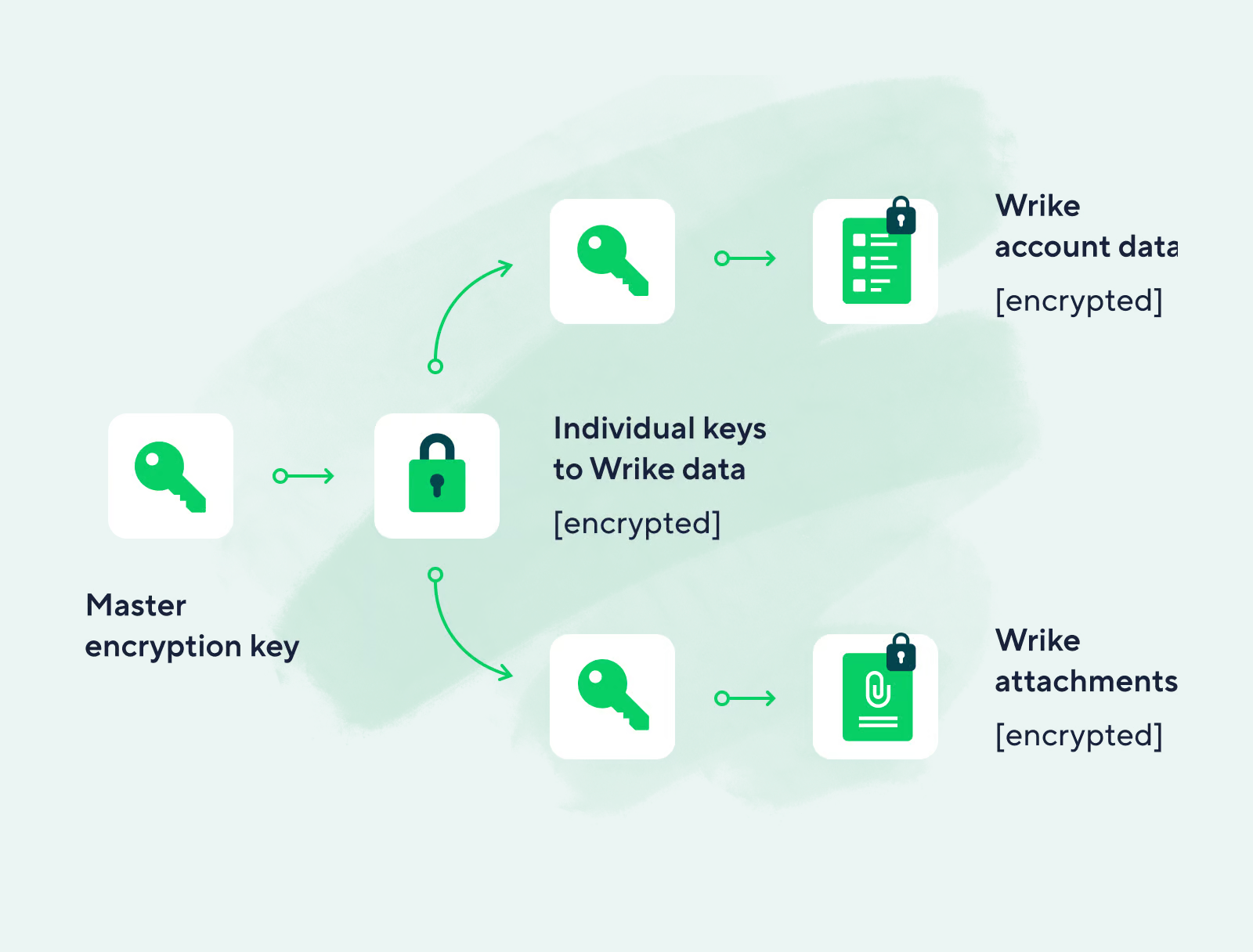

Because regulatory requirements are so vital in this industry, let’s start with the Wrike features that keep your banking project work secure. With an Enterprise or Pinnacle pricing plan, Wrike workspaces can include:

- SAML-based SSO

- 2-factor authentication

- Audit logs and activity reports

- Customizable user type, role, and access permissions

- Locked spaces for sensitive project information

- Wrike Lock for an additional layer of encryption for all your workspace data

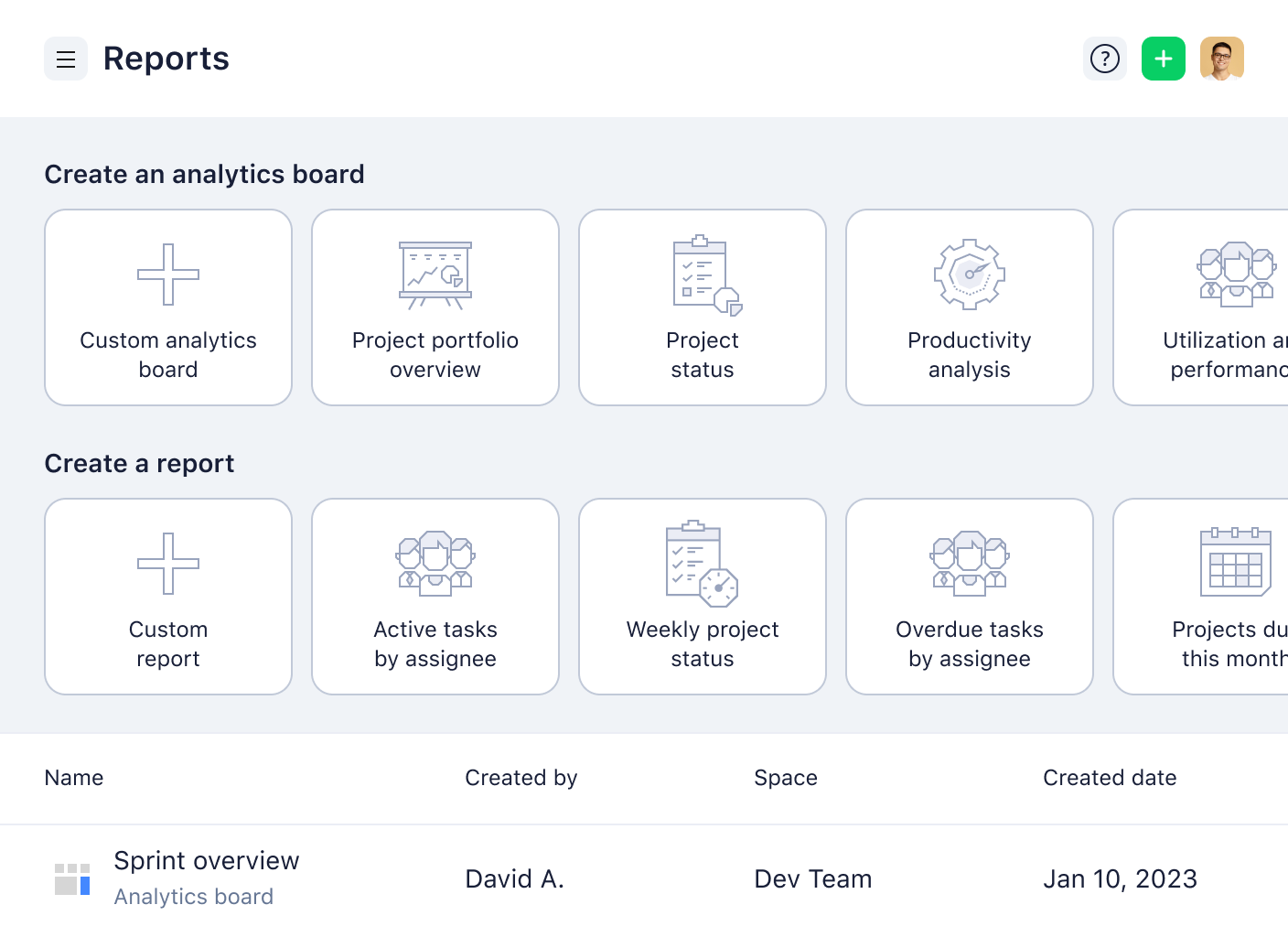

For example, Wrike includes powerful reporting software.

Say your team is working towards the launch of a new financial management feature for your private online banking customers. With Wrike, you can quickly generate a report — based on your current tasks, their statuses, your team’s capacity, and your historical performance — to show how you’re burning through the work.

This report might show, for example, that development and testing were on track, but the team responsible for the technical writing was beginning to see the number of tasks stack up. With this information, you can then adjust your approach and divert more resources to the tasks that are vital to the project’s regulatory approval.

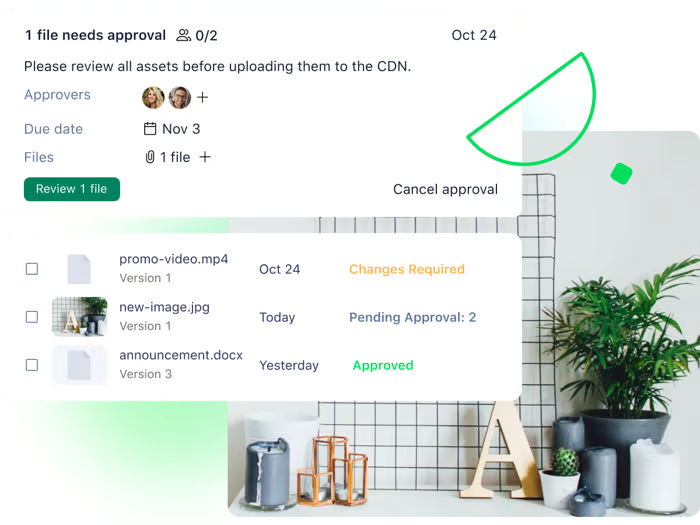

Expert insight: Moneytree optimizes a secure approval workflow

Moneytree is a retail financial services provider with more than 80 branches in the US and British Columbia.

The marketing team is responsible for campaign launches and blog content, and they have a high volume of assets in development at all times. But because technical, legal, and brand approvals in the financial industry are vital, they found their projects often stalled in the final stages as they waited for someone to sign off on the tasks. Their previous system saw them send one PDF to multiple reviewers, which made it difficult to track the feedback and requested changes.

Moneytree aimed to streamline the feedback process and have a real conversation about a new asset without having to schedule more meetings. When the team incorporated Wrike into their existing processes, they achieved exactly that.

The tool is interactive and we see everything in real time. We’re all working collaboratively together instead of alone waiting for emails. I have visibility on all projects.

Denise, VP of Marketing & Training

By sharing design assets in Wrike, Moneytree has centralized its review and approval process, reduced problems with version control, and automated many aspects of the approval process to reduce its average approval time from 7 days to 1.

With the rest of Wrike’s project management features, they’ve also:

- Scaled their team to 3x the size

- Increased their project speed by 75%

- Saved 156 hours that the project manager previously spent proofing assets

Get a cross-team project overview

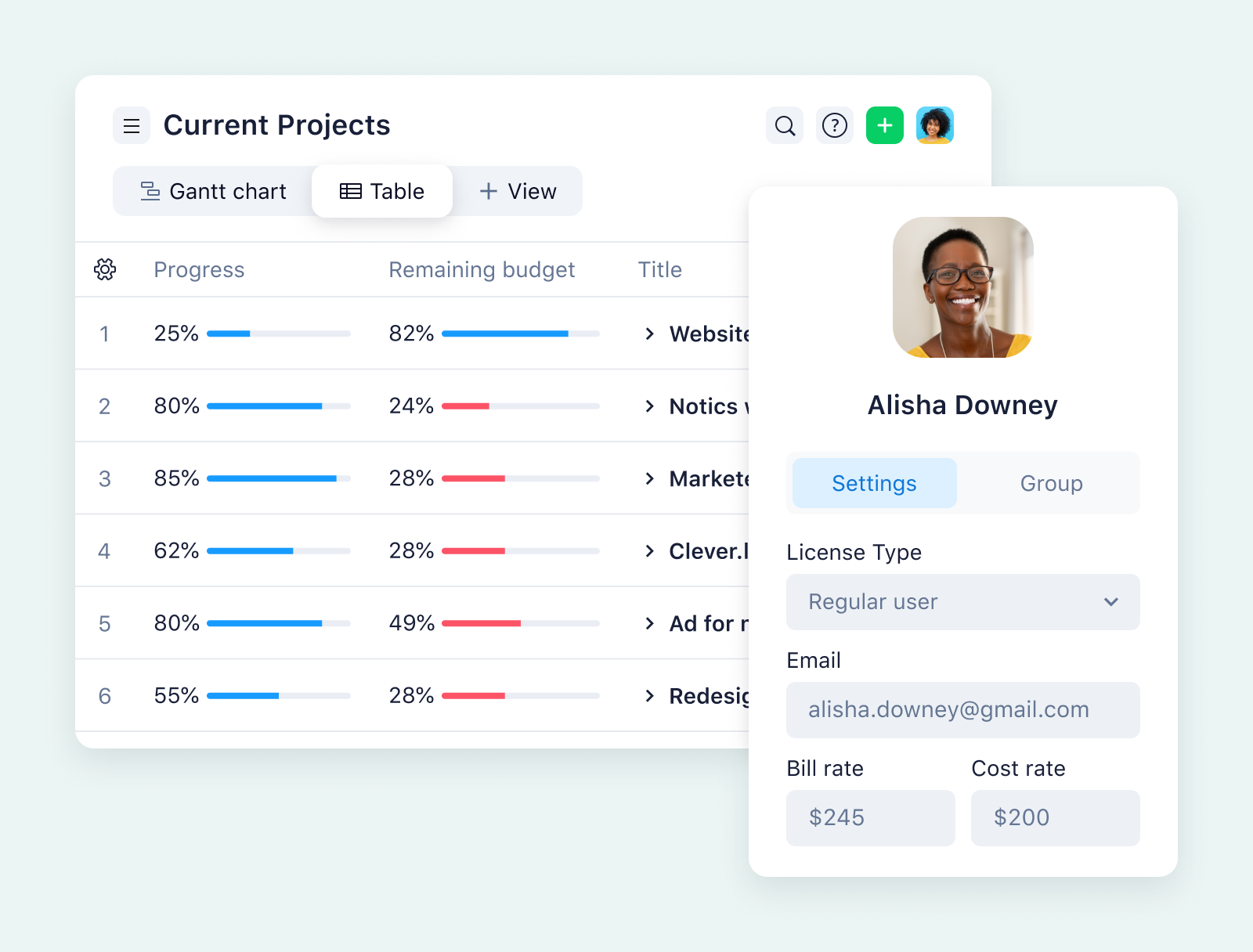

When you work in Wrike, you don’t just share communication tools and dashboards. With features like cross-tagging and customizable access roles, you can also share secure project workflows from end to end.

One of the things that often slows down banking project management is coordination between stakeholders.

For example, imagine you’re part of a marketing team in a heritage bank, and you’re developing new campaigns to help you compete against newer, online financial institutions. In this case, all the assets you produce could face additional scrutiny from stakeholders in upper management who are keen to preserve the company’s legacy. But when your project management plans have to make this jump between departments, they’re often slowed down by the differences between management systems and communication tools.

Wrike’s system completely streamlines cross-department workflows. Even if your project subteams work with different project management methodologies, you can view your current tasks in context — and all without duplication, internal emails, or the need to use a file sharing service.

Put simply, our unique cross-tagging feature means that tasks, documents, and project folders can exist in multiple workspaces at the same time, however those workspaces have been tailored. Each team — like the marketers and the upper management team I mentioned above — can view the latest version of the task, and any changes they make will be reflected across the different workspaces in real time.

Then, when it comes to cross-departmental approval workflows, those tools optimize the process. With Wrike’s commenting and document editing functions, people from across different subteams get instant notifications whenever their input is needed, so you can accelerate your feedback process and keep all the crucial details organized and transparent.

With hundreds of integrations, Wrike’s workflows can be automated from end to end. Our project management platform includes integrations with hundreds of the tools different departments use to complete their work, including legacy and external systems. This offers even more opportunities to close up gaps in your process and boost collaboration between your project teams.

Expert insight: Umpqua Bank consolidates internal and external communications

Umpqua Bank is a financial holding company based in Portland, OR.

This team always sets itself apart by prioritizing collaboration and finding creative ways to surprise its customers. But when the number of projects for the creative team quadrupled, they needed to upgrade their communication channels and workflows to maintain those same high standards.

To deliver their ambitious customer experience strategy, Umpqua’s marketing team members frequently collaborate with outside vendors. Previously, their only collaboration tool was email. When they had an idea for a new project, they contacted individual designers on the team, so all the conversations about project briefs, updates, and revisions were siloed in personal inboxes.

With Wrike, they centralized their project communications, bringing transparency to both internal discussions and conversations with external collaborators.

When we’re looking at 150 jobs a month, and trying to imagine how we’re going to accomplish getting all those jobs done, and how to organize them all — I can’t imagine how we would do it without a solution like Wrike.

Jason Resch, VP of Creative Service

The system Umpqua’s team members built in their Wrike workspace gives them real-time visibility of their entire project pipeline, and a better way to organize their work.

- Their request forms kick off new marketing projects by gathering key details and initiating a template workflow.

- Their task cards track every task in a project, so anyone with access can review the history of a job.

- Their project dashboards include an activity stream, so the team can keep up to date with the latest news on their ongoing work.

- Their automated reports show their progress from week to week, which helps them continually reprioritize and shuffle the workload to make the best use of their resources.

- Their email integration means they can communicate with external vendors throughout a project from within Wrike — and make that communication accessible to anyone who works on the task.

With these features, the team can manage their entire project load more effectively. Particularly, they note that they’re making more informed decisions about projects to prioritize and backlog. Wrike helps them base those decisions on project speed and importance, rather than project size alone.

Banking project management streamlined with Wrike

Banks and financial institutions need a secure, efficient, and customizable platform to manage their projects, and Wrike provides that space. Our project management software scales across the whole ecosystem of your ongoing projects, and gives every team the freedom to plan and track their contribution in the way that suits them best.

With Wrike’s suite of project management tools, you have the oversight you need to connect teams and help them collaborate safely, transparently, and efficiently in an audit-ready space. Whether you want to bring new services to market faster, manage your internal tech and data processes more efficiently, or keep up with changes in the industry, Wrike can be tailored to meet those goals.

Find out more about Wrike for banking project management today.